Why Digital Securities

Digital securities represent ownership of real world assets suchas quity, real estate, or private equity funds, enabled through a token on blockchain. Unlike virtual currencies like Bitcoin or Ethereum, they are securities issued under regulation

Read the research

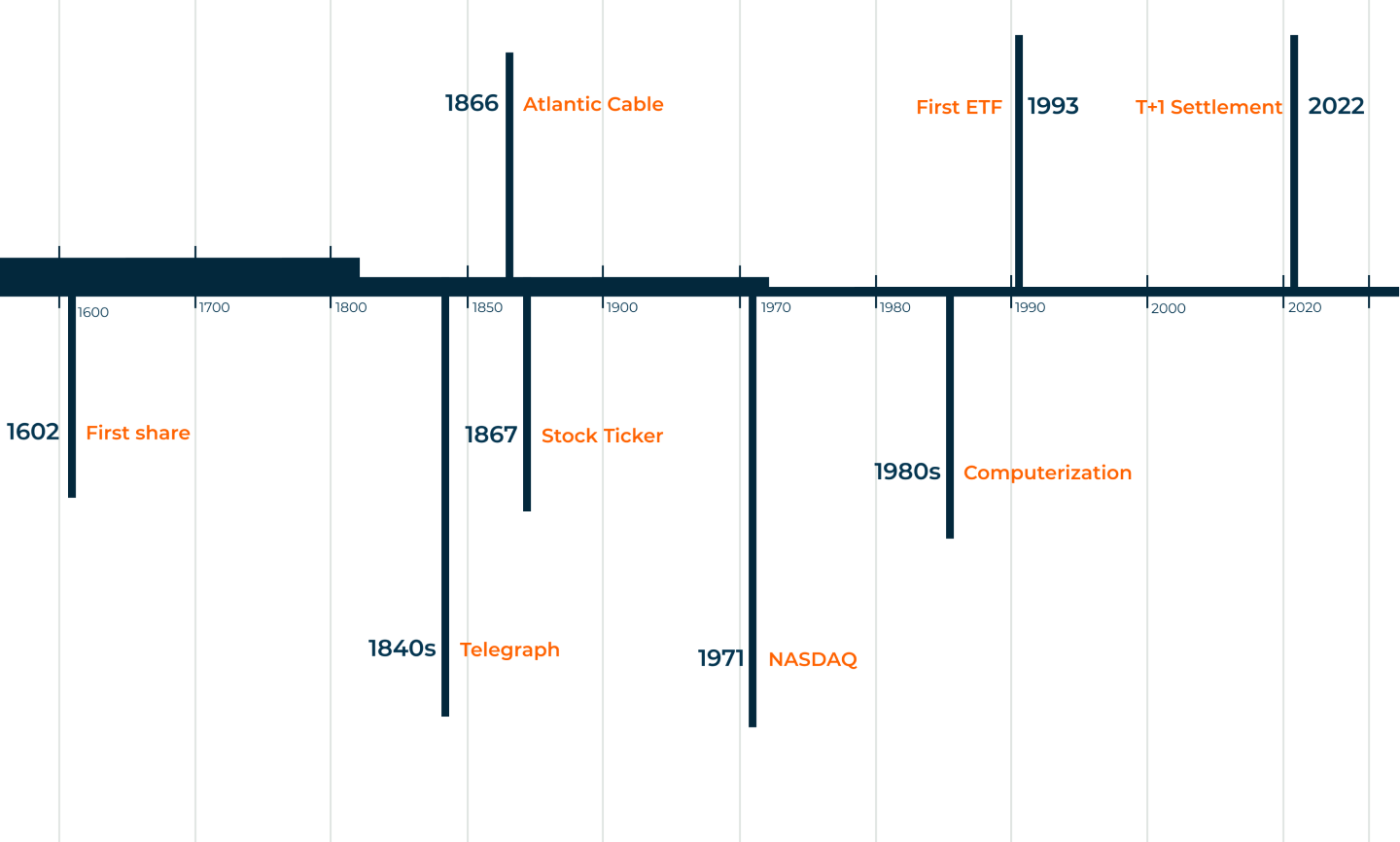

The Digital Evolution

Public securities have benefited enormously over the past several hundred years from technological innovations that increased accessibility, efficiency and reliability for public companies and investors. However, private markets have experienced few technological developments.

Our Research

In-depth research and analysis to drive investment decisions.

40+ Investment Opportunities

Real Estate, Mortgages, and Specialized funds

8% to 20+% Expected Returns*

Investments with

Medium to High risk

Low to high liquidity

$100M+

Capital Raised on Atlas One Platform

Thousands of Investors

Building their financial futures from as little as $1,000

Driving Growth in Digital Securities through Central Bank Digital Currencies

Central Banks around the world are researching or piloting Central Bank Digital Currencies (CBDCs). In 2018, the Bank for International Settlements (BIS) identified 63 central banks which started research in digital currencies.1 By January 2020, BIS’s study showed 80% of the worldwide central banks were engaged in CBDC projects.2 Many Central Banks are exploring CBDCs to improve payments efficiency or expand financial inclusion. We argue in this report that CBDC development will be key to driving growth of digital assets, particularly Digital Securities Offerings (DSOs), through the creation of instant digital asset settlement.

Read report

The Current State of Digital Securities

In this in-depth report we provide key market metrics about the digital securities market, as well as important updates about who are the key players in creating the infrastructure for a decentralized, regulated secondary marketplace.

Read report

2021 Q1 Blockchain & Digital Securities Macro Report

In this 13 page report we cover the digital securities market in depth, including factors such as blockchain adoption and emerging trends like NFTs.

Read report

Real Estate Digital Securities Market - Where Are We Now?

Real estate digital securities are taking over the world of tokenization. What are the latest trends in this emerging market?

Read report

INX, Ethereum and Real Estate DSOs

In this short report we cover our new addition to the Research Terminal: INX. We offer an in-depth analysis of Ethereum's rise over the past year, and the technical factors that drove this massive adoption of the protocol. Lastly, we cover the current developments in the real estate digital securities market.

Read report

Applications of Digital Securities

In this report we dive into banking applications of digital securities, as well as how other innovative businesses are leveraging the power of blockchain technology for capital raising.

Read report

Who is behind the $1b market cap?

In this report we analyze 3 digital securities incumbents: Overstock, Aspencoin and Blockchain Capital. We analyze potential risks and advantages in the securities, as well as historical performance and industry analysis.

Read report

Digitization of Fixed Income

Large banks and institutions are amongst the latest adopters of digital securities, particularly when it comes to fixed income investments. In this report, we conduct a deep dive into recent digitized fixed income offerings by large Singaporean banks.

Read report

Central Bank Digital Currencies: 2021

In this report we explore the current state of CBDCs (Central Bank Digital Currencies). In 2021, government-backed digital currencies are closer than ever to becoming a reality. We explore the potential benefits of such monetary instruments, as well as how various jurisdictions are experimenting with blockchain technology for securities settlements.

Read report

2021 Digital Securities Macro Report

In this Macro Report, we dissect the entire digital securities market. Our breakdown of the DSO ecosystem by industry, protocol and security type provides insightful information for investors. We also cover trading volume, as well as the overall growth of the market over the past year.

Read report

Why the Time Is Right to Launch a Digital Securities Firm

Private capital markets have grown and so is the need for a Digital Securities Firm to disrupt the industry to increase access and efficiency.

Read report

Private Capital Markets for All

The recent amendments by the U.S. Securities and Exchange Commission (SEC) to modernize the Accredited Investor definition is positive to expand access to private capital markets.

Read report

How Digital Securities Are Disrupting Private Real Estate Marketplaces

Real Estate Investment Distribution Strategies

Read report

Real Estate Digital Security Offerings - A Cost-Benefit Analysis

The Economics Behind Digital Securities

Read report

Atlas One Index is up 88% in 2021

The Atlas One Index is the first of its kind in the digital securities ecosystem. It encompasses securities in a variety of industries, but heavily represents real estate due to the sector’s recent increase in market share. The Atlas One Index is capitalization-based, similar to some of the most famous public equities indexes, such as the S&P 500. This type of index weighs different securities based on their market capitalization, meaning the larger an issuer is, the higher the impact it will have on the index’s movement.

Read report

Passive Income on the Blockchain

In this report we cover how blockchain technology is enabling both issuers and investors to create better opportunities for passive income, particularly when it comes to tokenized cash-flow producing real estate.

Read report

Digital Securities: Disrupting Capital Raising

In this report we explore the benefits of using digital securities for capital raising, with real-life examples and a timeline of the latest events in the DSO space.

Read reportSubscribe to our newsletter

Stay up to date on the latest news about Atlas One.

By clicking “Subscribe” you agree to receive marketing and promotional materials from Atlas One Digital Securities